closed end credit disclosures

Sub-sections a and b cover all types of closed end transactions and then the various following subsections have specific. Information on other ARM programs is available upon request.

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Closed-end credit agreements may be used to finance a.

. B The merchant or third-party creditor permits consumers to return any goods financed under the plan and provides consumers with a sufficient time to reject the plan and return the goods. The offers that appear on this site are from third. Closed-end credit agreements allow borrowers to buy expensive items and then pay for those items in the future.

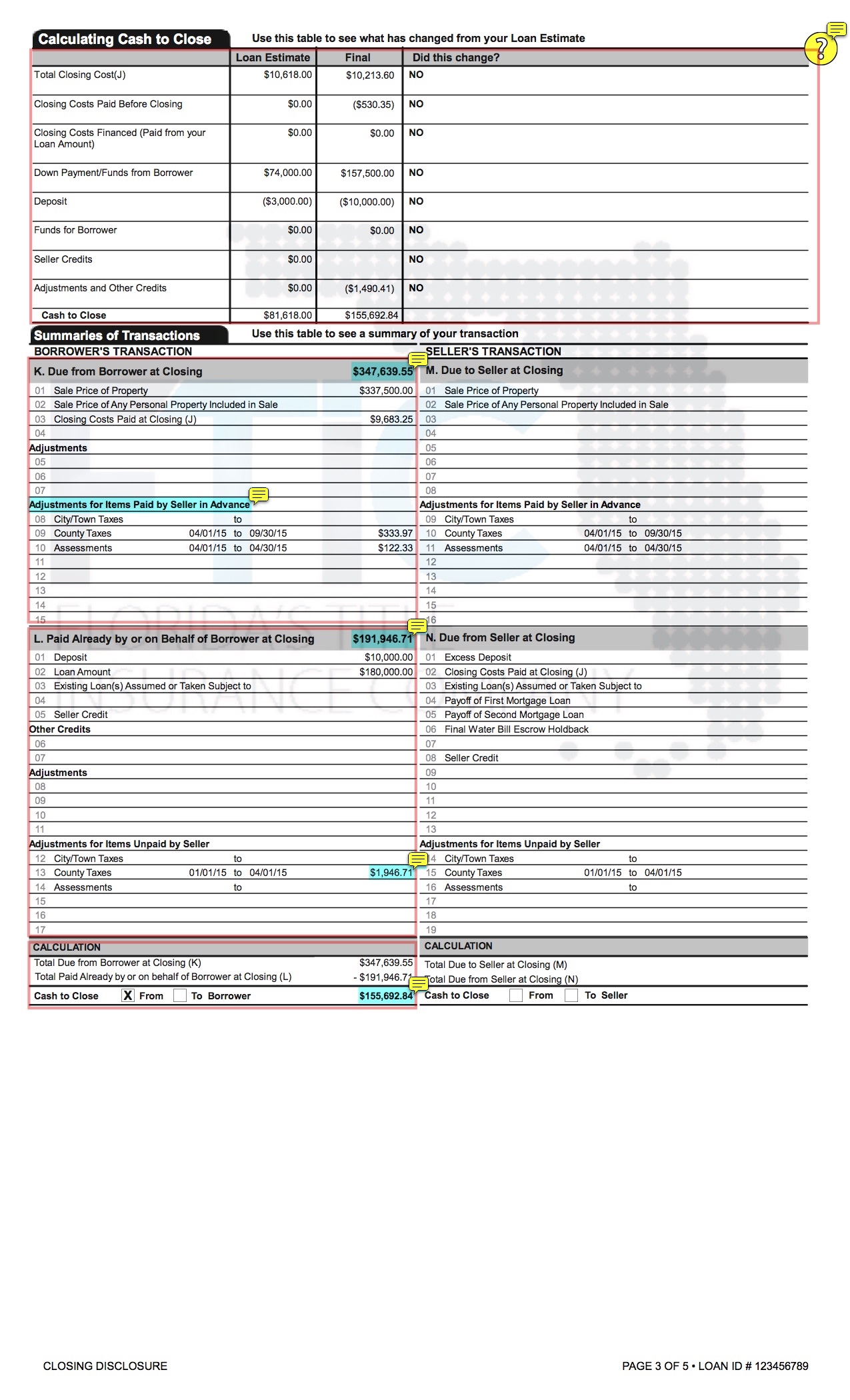

Closed-End Credit Disclosure Forms Review Procedures Closed-end consumer credit transactions secured by real property or a cooperative unit other than a reverse mortgage. Ii Any limitations on. Closed-end credit such as an installment loan or auto loan gives you a specific amount of money for a set time period.

This disclosure describes the features of the adjustable-rate mortgage ARM program you are considering. In closed-end vehicles valuation is typically important for performance advertising and for reporting purposes enabling the investors to determine the Private credit. 17 a Form of Disclosures Paragraph 17 a 1 1.

This standard requires that disclosures be in a reasonably understandable form. 102637 Content of disclosures for certain mortgage. Creditors may provide a disclosure that refers to debt cancellation or debt suspension coverage whether or not the coverage is considered insurance.

Subpart C - Closed-End Credit 102617 102624 Show Hide 102617 General disclosure requirements. For a closed-end transaction not subject to section 102619e and f determine whether the disclosures are accurately completed and include the following disclosures as applicable. Banks credit unions and private lenders may offer closed-end credit products including all types of personal loans.

Section 102619 e and f applies to closed-end consumer credit transactions that are secured by real property or a cooperative unit other than reverse mortgages subject to 102633. Intended for all lending personnel this course covers Regulation Zs key disclosure requirements for closed-end non-mortgage loans. I The circumstances under which the rate may increase.

4 The annual percentage rate and if the rate may increase after consummation the following disclosures. Creditors may use the model credit. I The circumstances under which the rate may increase.

4 The annual percentage rate and if the rate may increase after consummation the following disclosures. 2268 is the principal section for closed end credit disclosures. As mentioned earlier closed-end credit must be repaid in.

Unfortunately noif during the loan term a HELOC is converted from open-end credit to closed-end credit that would trigger closed-end credit requirements including the TRID disclosures. A Application disclosures In the case of any open end consumer credit plan which provides for any extension of credit which is secured by the consumers principal dwelling the creditor shall. The Credit Union will comply with the Truth-in-Lending Act and its implementing regulation Regulation Z by providing consumer borrowers with proper Truth-in-Lending disclosures for.

For example while the regulation. Students will learn the disclosure rules for annual. For closed end dwelling-secured loans subject to RESPA does it appear early disclosures are delivered or mailed within three 3 business days after receiving the consumers written.

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Ecfr Appendix H To Part 1026 Title 12 Closed End Model Forms And Clauses

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

Federal Register Truth In Lending Regulation Z

Mandatory Disclosures To Consumer

Definition Closed End Credit Is Defined As Credit That Must Be Repaid In Advisoryhq

Federal Register Regulation Z Truth In Lending

Defining Business Days For Lending Tca

12 Cfr Appendix H To Part 1026 Closed End Model Forms And Clauses Cfr Us Law Lii Legal Information Institute

Frb Designing Disclosures To Inform Consumer Financial Decisionmaking Lessons Learned From Consumer Testing

Chapter 5 Loans Finance Disclosure Other Real Estate Disclosures Ppt Video Online Download

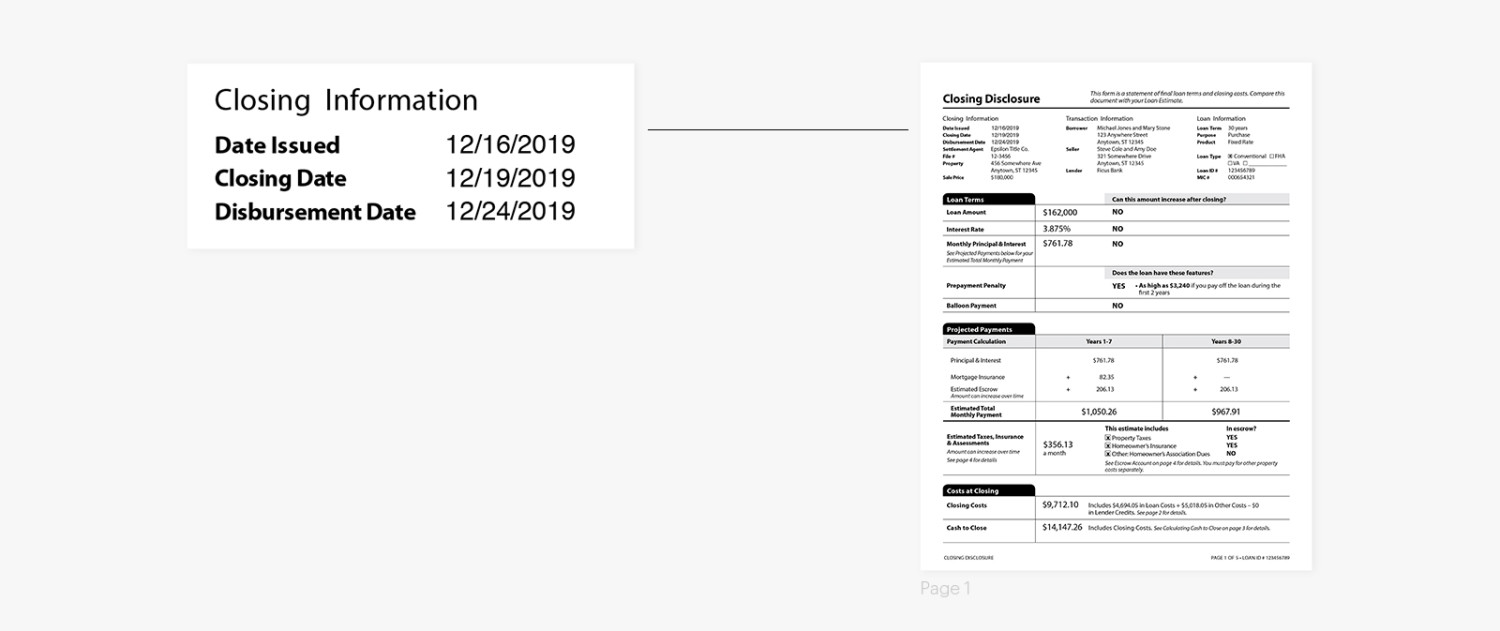

New Mortgage Documents What Are They

The Softpro Solution The Final Rule Patrick Hempen Softpro Corporation Svp Sales Marketing Ppt Download

A Guide To Understanding Your Closing Disclosure Better Better Mortgage

Consummation And Timing Of Closed End Disclosures Under Securian S

Ultimate Guide To Your Mortgage Closing Disclosure Forbes Advisor

Understanding Prepaids Impounds On Closing Disclosure Mortgage Blog